Exactly How a 2D Payment Gateway Improves Safety and Effectiveness in Ecommerce

Exactly How a 2D Payment Gateway Improves Safety and Effectiveness in Ecommerce

Blog Article

The Role of a Repayment Portal in Streamlining Ecommerce Payments and Enhancing User Experience

The integration of a repayment entrance is critical in the shopping landscape, offering as a protected avenue between vendors and customers. By enabling real-time deal handling and sustaining a range of settlement methods, these portals not only minimize cart desertion however also improve general consumer complete satisfaction.

Understanding Repayment Entrances

A settlement gateway works as an important intermediary in the shopping deal procedure, promoting the protected transfer of payment details between clients and merchants. 2D Payment Gateway. It enables online companies to approve numerous types of payment, including bank card, debit cards, and digital wallets, therefore broadening their customer base. The gateway operates by securing delicate details, such as card details, to guarantee that data is transferred safely online, reducing the danger of fraudulence and information breaches

When a consumer initiates a purchase, the payment entrance records and forwards the transaction data to the appropriate economic institutions for permission. This procedure is normally seamless and occurs within secs, providing consumers with a liquid purchasing experience. Furthermore, repayment portals play a crucial function in compliance with industry criteria, such as PCI DSS (Repayment Card Market Information Security Criterion), which mandates rigorous safety and security procedures for processing card payments.

Recognizing the technicians of payment gateways is vital for both consumers and sellers, as it straight influences deal efficiency and consumer trust fund. By making sure safe and secure and reliable purchases, payment gateways add considerably to the general success of shopping businesses in today's digital landscape.

Secret Features of Repayment Entrances

A number of crucial functions define the efficiency of repayment entrances in e-commerce, ensuring both protection and ease for users. Among one of the most critical functions is robust safety protocols, consisting of encryption and tokenization, which shield sensitive customer information throughout deals. This is important in cultivating trust fund in between customers and sellers.

Moreover, real-time purchase processing is essential for making certain that payments are completed swiftly, minimizing cart abandonment rates. Settlement entrances also offer scams detection tools, which keep an eye on purchases for suspicious task, further protecting both vendors and consumers.

Advantages for Ecommerce Services

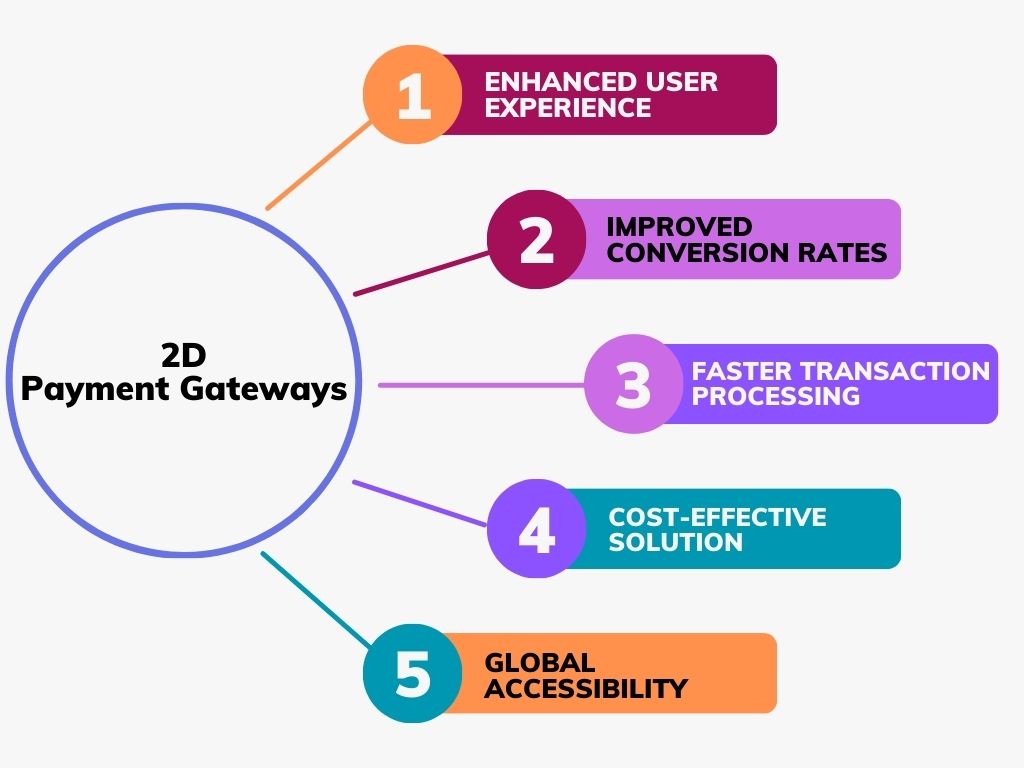

Countless benefits arise from integrating repayment entrances right into shopping organizations, dramatically enhancing operational efficiency and customer complete satisfaction. Most importantly, settlement gateways help with smooth transactions by safely processing payments in real-time. This capability lowers the possibility of cart desertion, as clients can swiftly complete their acquisitions without unnecessary hold-ups.

Moreover, repayment portals support numerous repayment techniques, suiting a diverse array of customer preferences. This flexibility not just draws in a more comprehensive client base however likewise cultivates loyalty among existing customers, as they really feel valued when provided their favored settlement choices.

Furthermore, the assimilation blog of a payment gateway usually causes boosted protection functions, such as file encryption and scams discovery. These measures shield delicate consumer information, thereby constructing trust and integrity for the shopping brand name.

Moreover, automating repayment processes through portals reduces hands-on workload for team, allowing them to concentrate on strategic initiatives instead than regular tasks. This functional performance equates into expense financial savings and boosted resource allocation.

Enhancing Customer Experience

Integrating an efficient settlement portal is critical for improving customer experience in e-commerce. A reliable and seamless settlement procedure not just constructs consumer trust however likewise minimizes cart desertion prices. By giving multiple payment options, such as credit report cards, digital pocketbooks, and bank transfers, services cater to varied customer preferences, consequently improving satisfaction.

In addition, an user-friendly interface is essential. Settlement entrances that supply intuitive navigating and clear guidelines enable customers to complete purchases swiftly and easily. This ease of usage is important, especially for mobile consumers, that require enhanced experiences customized to smaller screens.

Safety and security functions play a considerable function in user experience as well. Advanced encryption and scams detection systems comfort consumers that their delicate data is shielded, fostering confidence in the purchase procedure. Additionally, transparent interaction regarding plans and charges enhances reputation and minimizes possible aggravations.

Future Fads in Repayment Handling

As e-commerce proceeds to develop, so do the patterns and innovations shaping settlement processing (2D Payment Gateway). The future of repayment processing is noted by numerous transformative fads that guarantee to improve effectiveness and customer complete satisfaction. One significant trend is the surge of artificial knowledge (AI) and artificial intelligence, which are being significantly integrated right into settlement portals to reinforce safety and security via advanced fraudulence detection and danger assessment

In addition, the adoption of cryptocurrencies is gaining traction, with more services exploring blockchain innovation as a feasible choice to standard payment approaches. This change not only uses lower purchase costs but likewise interest an expanding market that worths decentralization and privacy.

Contactless repayments and mobile wallets are ending up being mainstream, driven by the need for faster, extra hassle-free purchase methods. This pattern is further fueled by the enhancing occurrence of NFC-enabled devices, making it possible for seamless purchases with just a faucet.

Last but not least, the focus on governing compliance and read data security will shape settlement handling methods, as organizations aim to develop trust with customers while sticking to developing lawful frameworks. These patterns collectively suggest a future where repayment handling is not just faster and extra secure yet likewise much more aligned with customer assumptions.

Verdict

In final thought, repayment gateways function as important parts in the ecommerce community, helping with reliable and protected deal handling. By offering varied repayment options and focusing on customer experience, these gateways substantially reduce cart desertion and improve consumer complete satisfaction. The ongoing evolution of settlement modern technologies and security actions will additionally enhance their role, guaranteeing that e-commerce businesses can fulfill the demands of progressively innovative customers while promoting trust fund and integrity in on the internet transactions.

By enabling real-time transaction processing and supporting a selection of payment approaches, these portals not just mitigate cart abandonment yet also boost general client complete satisfaction.A settlement gateway serves as a vital intermediary in the ecommerce purchase process, facilitating the safe and secure transfer of repayment details in between vendors and clients. Repayment gateways play an essential duty in conformity with sector requirements, such as PCI DSS (Settlement Card Industry Data Safety Standard), which mandates stringent safety steps for refining card settlements.

A flexible settlement gateway accommodates credit scores and debit cards, digital purses, and different settlement methods, catering to diverse consumer preferences - 2D Payment Gateway. Payment gateways facilitate smooth transactions by securely refining settlements in go to my site real-time

Report this page